According to ATTOM Data Solutions’ Q1 2020 U.S. Home Equity and Underwater Report just released, 14.5 million residential properties in the U.S. were considered equity-rich in the first quarter of 2020. The combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value.

ATTOM’s latest home equity and underwater analysis reported that the count of equity-rich properties in Q1 2020 represented 26.5 percent, or about one in four, of the 54.7 million mortgaged homes in the U.S. That percentage was down slightly from the 26.7 percent level in Q4 2019. The report noted these latest figures were derived from the last data recorded before the economic fallout from the Coronavirus pandemic.

ATTOM’s Q1 2020 report revealed that just 3.6 million, or one in 15, mortgaged homes in Q1 2020 were considered seriously underwater, meaning a combined estimated balance of loans secured by the property were at least 25 percent more than the property’s estimated market value. That figure represented 6.6 percent of all U.S. properties with a mortgage, up slightly from 6.4 percent in Q4 2019.

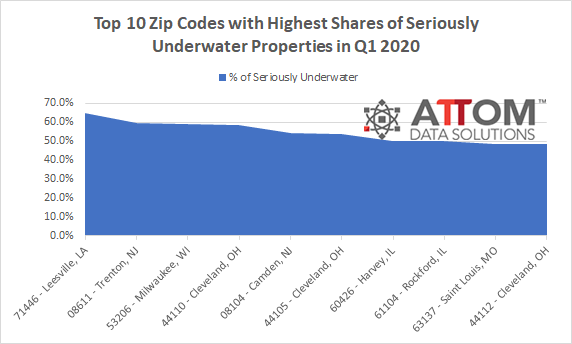

Among the 8,248 U.S. zip codes with at least 2,000 properties with mortgages in Q1 2020 included in the analysis, there were 157 zip codes where at least a quarter of all properties with a mortgage were seriously underwater.

The report featured the top five zip codes with the highest shares of seriously underwater properties in Q1 2020. They were 71446 in Leesville, LA (65.1 percent seriously underwater); 08611 in Trenton, NJ (59.8 percent); 53206 in Milwaukee, WI (59.2 percent); 44110 in Cleveland, OH (58.6 percent); and 08104 in Camden, NJ (54.6 percent).