ATTOM Data Solutions’ Q3 2020 U.S. Home Flipping Report presented a continuation of opposing trends in the third quarter of 2020, with flipping rates down but profits up, reflecting broader national housing market patterns as the worldwide Coronavirus continued spreading across the United States.

According to ATTOM’s latest home flipping analysis, while the home-flipping rate dropped again in Q3 2020, both profits and profit margins increased. The gross profit on the typical home flip nationwide rose in Q3 2020 to $73,766 – the highest amount since at least 2000. That amount was up from $69,000 in Q2 2020 and from $61,800 in Q3 2019.

The Q3 home flipping report stated that gain pushed profit margins up, with the typical gross flipping profit of $73,766 translating into a 44.4 percent ROI compared to the original acquisition price. The gross flipping ROI was up from 42.9 percent in Q2 2020 and 40.3 percent in Q3 2019. The report noted the improvement in the typical ROI marked the second consecutive year-over-year increase following nine straight quarters of declines.

ATTOM’s third quarter home flipping analysis reported that 57,155 single-family homes and condos were flipped in the U.S. in the third quarter, representing 5.1 percent of all home sales, or one in 20 transactions. That rate was down from 6.7 percent of all home sales in Q2 2020, or one in 15, and from 5.5 percent, or one in 18 sales, in Q3 2020.

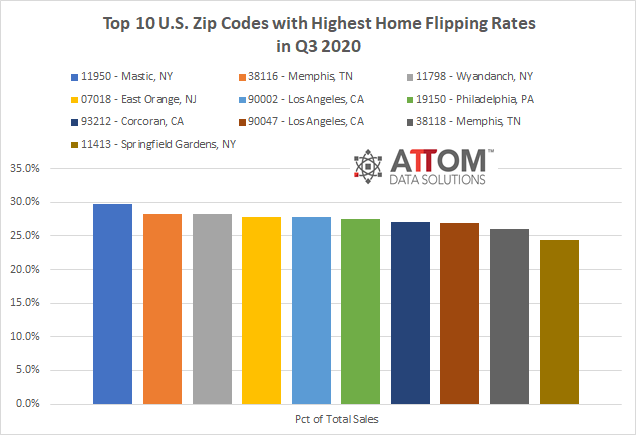

Picture: ATTOM Data Solutions